Appraisals and inspections serve distinct purposes in the home-buying process. An appraisal determines a property’s monetary value for financing, conducted by licensed appraisers hired by lenders. Inspections, performed by certified home inspectors at the buyer’s request, identify potential issues with the structure and systems. Appraisals typically occur after inspections but before closing, while inspections are post-offer evaluations. Both services cost around $300-$500, with buyers responsible for expenses. Appraisals impact negotiation strategies and lending criteria, while inspections uncover issues that may lead to repair requests or price reductions. Understanding these differences is vital for making informed decisions in real estate transactions.

Defining Appraisals and Inspections

While both are vital steps in the home-buying process, appraisals and inspections serve distinctly different purposes that you’ll need to understand. An appraisal determines the monetary value of a property, while an inspection identifies potential issues with its structure and systems. These two procedures provide unique insights that can significantly impact your home-purchasing decision.

Appraisal accuracy is essential for financing purposes. When you’re seeking a mortgage, lenders require an appraisal to confirm the property’s value aligns with the loan amount. A professional appraiser conducts this assessment by comparing the property to similar homes in the area. They consider factors such as location, size, and recent sales data to determine the fair market value.

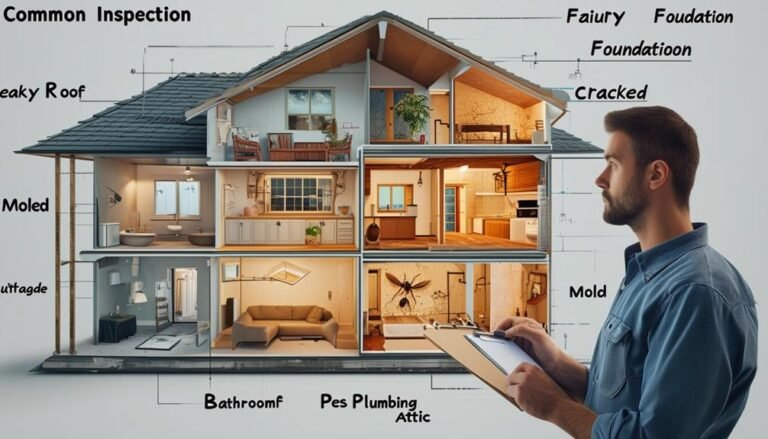

On the other hand, inspection thoroughness is key for your peace of mind as a buyer. While optional, a home inspection is highly recommended to uncover any hidden problems or potential safety hazards. A certified home inspector will thoroughly examine the property’s major systems, including electrical, plumbing, and HVAC. They’ll also assess the structural integrity of the home, looking for signs of damage or wear.

An appraisal for financing is typically mandatory, whereas an inspection for peace of mind is your choice. However, both provide valuable information that can help you make an informed decision. The appraisal ensures you’re not overpaying for the property, while the inspection alerts you to any necessary repairs or maintenance issues you may face as a homeowner.

Key Differences in Purpose

Now that we’ve established what appraisals and inspections are, let’s focus on their key differences in purpose. The primary distinction lies in their intended outcomes and the parties they benefit most.

Appraisals play a vital role in the mortgage approval process, determining a property’s fair market value. Lenders require appraisals to ensure the home’s value aligns with the loan amount they’re considering. This process protects both the lender and the buyer from overpaying for a property. The importance of accuracy in appraisals can’t be overstated, as it directly impacts the buyer’s ability to secure financing and the lender’s risk assessment.

Inspections, on the other hand, primarily benefit the buyer by providing a thorough evaluation of the property’s physical condition. They’re not typically required by lenders but are highly recommended for buyers to make informed decisions. Inspections reveal potential issues, needed repairs, and maintenance concerns that might not be apparent during a casual walkthrough. From a buyer’s perspective, this information is invaluable for negotiating the purchase price or requesting repairs before closing.

While appraisals fulfill regulatory requirements set by lenders and government agencies, inspections aren’t subject to the same mandates. However, they offer a seller’s benefit by potentially identifying issues that could be addressed before listing, potentially increasing the property’s value and marketability.

In essence, appraisals focus on financial valuation, while inspections emphasize the property’s physical condition. Both play crucial roles in the home-buying process, providing different but equally important information to all parties involved.

Who Performs Each Service

The key players in appraisals and inspections bring distinct expertise to the home-buying process. When you’re navigating the intricate world of real estate transactions, you’ll encounter two vital professionals: licensed appraisers and certified home inspectors.

Licensed appraisers are the experts responsible for determining a property’s market value. They’ve undergone specific training and met strict qualifications required by state licensing boards. Their scope of work performed includes analyzing market data, comparing similar properties, and evaluating the specific features of the home in question. Appraisers are typically hired by lenders to guarantee the property’s value aligns with the loan amount you’re seeking.

On the other hand, certified home inspectors focus on evaluating the property’s physical condition. They’ve completed specialized training programs and obtained certifications from recognized organizations. The scope of work performed by inspectors involves a thorough examination of the home’s structure, systems, and components. You’ll often request an inspection as a buyer to gain insight into the property’s safety and maintenance needs.

To better understand the distinctions between these professionals, consider the following:

- Qualifications: Appraisers require state licensing, while inspectors need certification from industry organizations.

- Focus: Appraisers determine value, inspectors evaluate condition.

- Client: Lenders typically hire appraisers, buyers usually request inspectors.

Both appraisers and inspectors play essential roles in the home-buying process, providing you with valuable information from different perspectives. While appraisers help ensure you’re not overpaying for a property, inspectors give you a clear picture of the home’s current state and potential future issues.

Timing in Home Buying Process

Understanding who performs appraisals and inspections is just one piece of the puzzle; it’s equally important to know when these services occur in the home buying process. Timing considerations play a pivotal role in the decision-making process for both buyers and lenders.

Home inspections typically fall into the category of post-offer evaluations. Once you’ve made an offer on a property and it’s been accepted, you’ll have the opportunity to schedule a home inspection. This timing allows you to assess the property’s condition before finalizing the purchase. It’s common for buyers to include a home inspection contingency in their purchase agreement, giving them the ability to renegotiate or even back out of the deal if significant issues are discovered.

Appraisals, on the other hand, are usually conducted after the inspection but before the closing. Lenders order appraisals to determine the property’s market value and verify it supports the loan amount. This step is vital for mortgage approval and typically occurs later in the home buying process.

While pre-offer assessments are less common, some buyers may choose to conduct preliminary inspections before making an offer, especially in competitive markets. However, most detailed evaluations occur post-offer.

It’s important to note that while appraisals are generally required for mortgage approval, home inspections are optional but highly recommended. The timing of these services allows you to make informed decisions about the property’s condition and value before committing to the purchase. Understanding this sequence in the home buying process can help you navigate the steps more effectively and confidently.

Cost Considerations

Cost factors play a pivotal role when deciding between appraisals and inspections in the home buying process. As a buyer, you’ll need to weigh the financial implications of both services and budget accordingly. The cost breakdown for appraisals and inspections is relatively similar, with each typically ranging from $300 to $500. However, it’s important to note that you’ll likely be responsible for covering these expenses out of pocket.

When budgeting for your home purchase, keep in mind that appraisals are more commonly required for mortgage approvals. This means you may need to prioritize the appraisal cost in your financial planning. However, don’t overlook the value of a home inspection, as it can provide vital information about the property’s condition and potential future expenses.

To help you navigate the cost considerations and negotiation strategies for appraisals and inspections, ponder the following points:

- Factor in the possibility of needing both services, which could total $600 to $1,000.

- Research local service providers to find competitive rates without sacrificing quality.

- Discuss with your real estate agent the possibility of negotiating these costs with the seller.

Understanding the differences between appraisals and inspections can help you make informed decisions about allocating your budget. While appraisals focus on determining the property’s market value, inspections assess its physical condition and safety. By carefully pondering the costs and benefits of each service, you can make sure you’re making a sound investment in your future home.

Impact on Real Estate Transactions

When you’re navigating the intricate world of real estate transactions, both appraisals and inspections hold significant sway over the outcome of your deal. These two procedures play vital roles in determining the property’s value and condition, respectively, which can greatly impact your negotiation strategies.

Appraisals are necessary for establishing a fair market value for the property. This valuation serves as a baseline for your negotiations, guaranteeing that you’re neither overpaying nor underselling. If an appraisal comes in lower than the agreed-upon price, you may need to renegotiate or secure additional financing. Conversely, a higher appraisal can bolster your position as a seller.

Inspections, on the other hand, can uncover potential issues that may affect the property’s value or desirability. The discoveries from an inspection report can lead to further negotiations, such as requesting repairs or price reductions. In some cases, severe issues discovered during an inspection may even result in the termination of the deal.

Both procedures also carry legal implications. Appraisals are often required by lenders to confirm the property’s value meets their lending criteria. Failure to obtain a satisfactory appraisal can jeopardize your financing. Similarly, inspections can protect you from undisclosed defects, potentially shielding you from future legal disputes.

In essence, appraisals and inspections serve as safeguards for all parties involved in the transaction. They provide valuable information that helps you make informed decisions, mitigate risks, and secure a fair and transparent deal. By understanding the impact of these procedures, you can navigate your real estate transaction more effectively and confidently.

Why is an Appraisal Different from an Inspection in the Buying Process?

When buying a property, it’s crucial to understand the impact of appraisals on buying. An appraisal determines the value of the property, while an inspection assesses its condition. The appraisal influences the amount a lender is willing to loan, while the inspection identifies any necessary repairs. Both are important steps in the buying process.

Choosing Between Appraisal and Inspection

While both assessments and examinations play key roles in real estate transactions, you’ll need to know which one best suits your specific situation and goals. Understanding the pros and cons of each can help you make an informed decision.

Assessments are vital for mortgage approval and determining a home’s market value. They’re typically ordered by the lender and focus on the property’s overall worth. The pros include setting an appropriate selling price and meeting lender requirements. However, assessments don’t investigate the property’s condition or potential issues, which can be a significant drawback for buyers.

Examinations, on the other hand, are essential for buyers who want to ensure they’re making a sound investment. While optional, they provide a thorough evaluation of the property’s condition. The significance for buyers can’t be overstated, as examinations reveal:

- Structural issues that may require costly repairs

- Safety concerns that could impact your family’s well-being

- Potential negotiation points to adjust the purchase price

When choosing between an assessment and examination, consider your primary objectives. If you’re seeking mortgage approval and want to confirm the property’s market value, an assessment is necessary. However, if you’re concerned about the home’s condition and potential hidden problems, an examination is invaluable.

In many cases, it’s advisable to pursue both an assessment and examination. This thorough approach ensures you have a complete understanding of the property’s value and condition, allowing you to make the most informed decision possible in your real estate transaction.

Conclusion

As you weigh your options, remember that appraisals and inspections serve distinct purposes in your home-buying journey. While an appraisal determines the property’s value, an inspection reveals its condition. You’ll need to contemplate timing, cost, and impact of your transaction carefully. Don’t rush your decision—each service offers unique insights. Ultimately, the choice between an appraisal and an inspection depends on your specific needs and the requirements of your lender. Choose wisely to guarantee a smooth real estate transaction.