When you’re planning your estate in Toronto, you can’t overlook the impact of real estate ownership on your legacy. Your property is likely one of your most valuable assets, and how you choose to transfer it can greatly affect your beneficiaries’ financial future. From tax implications to potential family disputes, the decisions you make now will shape what you leave behind. As you consider your options, you’ll need to navigate complex legal and financial landscapes unique to Toronto’s real estate market. But don’t worry—with the right strategies, you can guarantee your property becomes a lasting gift rather than a burden.

Key Takeaways

- Real estate often forms a significant portion of an estate’s value, influencing wealth distribution among heirs.

- Capital gains tax and probate fees can substantially reduce the value of inherited properties in Toronto.

- Trusts offer privacy, control, and potential tax benefits when transferring real estate assets to beneficiaries.

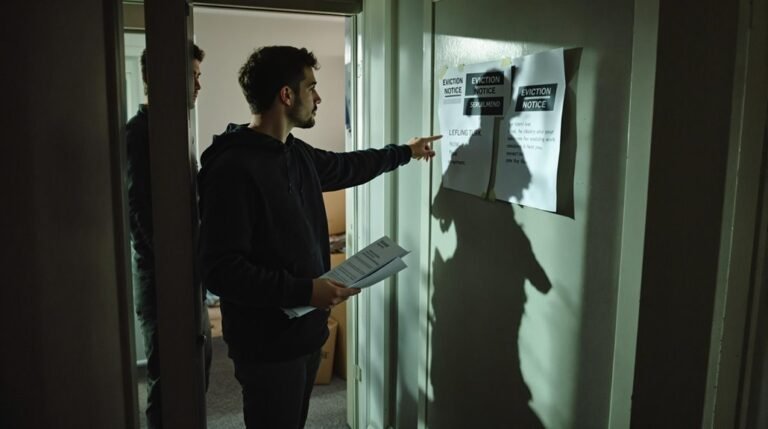

- Clear documentation and open communication about property distribution help prevent conflicts among heirs.

- Regular estate plan reviews ensure compliance with changing laws and accurately reflect current wishes for real estate assets.

Real Estate’s Role in Estate Planning

As you commence on estate planning, it’s essential to recognize the significant role real estate plays in your overall wealth strategy.

Let’s face it: your property isn’t just a place to hang your hat—it’s a cornerstone of your legacy. And boy, does it complicate things. When selling property, legal obligations include disclosing major defects and providing essential documentation, which can impact your estate’s value and potential inheritances.

Think about it. Your real estate assets are likely a huge chunk of your net worth. It’s not like you can just divvy up a house like a pile of cash. No, it’s a whole different ballgame.

And here’s where things get messy: heirs squabbling over property like kids fighting for the last slice of pizza. Sound familiar?

But wait, there’s more! The taxman’s always lurking, ready to take a bite out of your hard-earned wealth. Capital gains tax on real estate? It’s enough to make you want to pull your hair out.

Fifty percent of the property’s value increase could vanish faster than ice cream on a hot day. Talk about leaving a bitter taste in your mouth.

So, what’s a savvy property owner to do? Enter trusts—your secret weapon in the estate planning arsenal.

They’re like a force field for your real estate, keeping it safe from probate and nosy relatives. Plus, they give you control from beyond the grave. Spooky, right?

Here’s the kicker: proper planning isn’t just about avoiding family feuds and outsmarting the taxman. It’s about preserving your legacy, ensuring your property passes smoothly to the next generation.

Isn’t that what it’s all about?

Property Transfer Strategies

When it comes to property transfer strategies, you’ve got a toolbox full of options. But let’s face it, most people are clueless about how to use them effectively. It’s time to wise up.

Legal document review is essential in these strategies, ensuring all paperwork is ironclad and protects your interests. A real estate lawyer can be your secret weapon in maneuvering the complexities of property transfers.

Will-based transfers? They’re the old standby. You can designate beneficiaries directly in your will, making sure your real estate goes where you want it to after you kick the bucket. But here’s the kicker: it’s not always the smartest move.

Trust-based transfers are where it’s at. They’re like a VIP pass for your property, skipping the whole probate circus. Privacy? Check. Control? Double-check. It’s like giving your assets a first-class ticket to your beneficiaries.

But don’t think you can just wing it. Documentation is key. Deeds of gift, promissory notes – these aren’t just fancy legal terms. They’re your insurance against family squabbles. Because nothing says “I love you” like an ironclad legal document, right?

Here’s the thing: your estate plan isn’t a set-it-and-forget-it deal. Life changes, laws change, and suddenly your brilliant plan is about as useful as a chocolate teapot. Regular updates are non-negotiable.

And taxes? Oh boy. Capital gains can take a big bite out of your beneficiaries’ inheritance. It’s like the government’s parting gift to you. Isn’t that thoughtful?

Look, estate planning isn’t sexy. But neither is leaving your loved ones with a mess to clean up. So get smart about your property transfer strategies. Your legacy depends on it.

Tax Implications for Toronto Properties

Diving into the tax implications for Toronto properties, you’re faced with a minefield of potential costs that can chip away at your estate’s value. It’s enough to make you want to throw your hands up in despair!

Let’s start with the biggie: capital gains tax. Sell your property or pass it on, and you could be looking at a whopping 50% tax on your profit. Ouch! But wait, there’s a silver lining – the principal residence exemption. It’s like a get-out-of-jail-free card for your primary home. The catch? You can only use it for one property at a time. Talk about Sophie’s choice for real estate moguls!

And don’t forget about probate fees. At 1.5% of your estate’s value, they might seem small, but they add up fast. It’s like death by a thousand paper cuts for your heirs.

| Strategy | Pros | Cons |

|---|---|---|

| Gifting property | Reduces estate value | Immediate tax hit |

| Principal residence exemption | Tax shelter | Limited to one property |

| Life insurance | Provides liquidity | Ongoing premiums |

Now, you might think gifting property before you kick the bucket is a smart move. Hold your horses! It could trigger immediate capital gains tax. It’s like robbing Peter to pay Paul, but you’re both Peter and Paul.

Liquidity is key. Without it, your heirs might be forced to sell assets just to pay the taxman. Life insurance can be a lifesaver here, providing the cash needed to cover these pesky obligations.

In this game of estate planning chess, you’ve got to think several moves ahead. It’s frustrating, it’s complex, but with the right strategies, you can protect your legacy from becoming the taxman’s windfall.

Trusts and Real Estate Assets

While the tax implications might seem intimidating, trusts offer a powerful tool for managing your real estate assets and streamlining your estate planning.

Let’s face it: conventional estate planning can be a nightmare. But trusts? They’re a game-changer.

Affordable home ownership initiatives in Toronto have made real estate more accessible, increasing the importance of proper estate planning for a wider range of homeowners.

Think of a trust as your real estate’s personal bodyguard. It protects your property, manages it efficiently, and guarantees a smooth handover to your beneficiaries. No probate mess, no fuss. Isn’t that what you want for your loved ones?

Revocable living trusts are like having your cake and eating it too. You maintain control of your property while you’re alive, but when you’re gone, it’s distributed hassle-free.

It’s like setting up a VIP pass for your heirs to bypass the probate queue. Smart, right?

But wait, there’s more. Irrevocable trusts are the Fort Knox of estate planning. They shield your real estate from creditors and can greatly reduce estate taxes.

Who doesn’t want to stick it to the taxman?

Trusts also let you play puppetmaster from beyond the grave. Want your beach house used for family reunions? Or your condo to fund your grandkid’s education?

A trust makes it happen. It’s like leaving a to-do list for your assets.

And here’s the kicker: privacy. Unlike wills, trusts keep your real estate dealings out of public records.

No nosy neighbors peeking at your property portfolio. It’s your business, and it stays that way.

Conflict Prevention Among Beneficiaries

As you plan your estate, preventing conflicts among beneficiaries should be a top priority. Let’s face it: family disputes over inheritance can turn ugly fast. It’s time to ditch the old “let them figure it out” approach and take charge of your legacy.

Clear documentation is key. Don’t leave your heirs guessing about your intentions. Spell it out in black and white, especially when it comes to real estate. Trust me, you don’t want your kids fighting over who gets the family cottage.

Here’s a radical idea: talk to your family about your plans. I know, I know, it’s not easy. But open communication can work wonders in setting expectations. Imagine the shock on your son’s face when he learns you’re leaving the house to his sister. Better to have that conversation now, right?

Consider using trusts. They’re not just for the ultra-wealthy anymore. A revocable living trust can give you more control over how your property is distributed. It’s like being the puppet master of your own estate.

| Strategy | Benefit | Implementation |

|---|---|---|

| Clear documentation | Reduces misunderstandings | Detailed will |

| Open communication | Sets expectations | Family meetings |

| Trusts | Controlled distribution | Revocable living trust |

| Equalization clauses | Maintains fairness | Include in will |

| Regular updates | Reflects current intentions | Annual review |

Don’t forget about equalization clauses. They’re your secret weapon against sibling rivalry. And for heaven’s sake, review your estate plan regularly. Laws change, families change, and your dusty old will from 1995 isn’t cutting it anymore.

Conclusion

You can’t ignore real estate in your estate plan. It’s too big a deal. Sure, it’s a headache, but leaving it to chance? That’s asking for trouble. Get smart about trusts, taxes, and transfers. Your heirs will thank you. Don’t let the government or family squabbles eat up your hard-earned wealth. Take control now. It’s your legacy on the line. Isn’t it worth the effort to protect it?