When your Toronto real estate deal goes belly-up, it’s like watching your dream home crumble before your eyes—only the rubble is made of legal papers and dollar signs. You might lose that hefty deposit, face a lawsuit faster than you can say ‘closing costs,’ or watch your credit score plummet like a fallen soufflé. Sellers aren’t off the hook either; they could be stuck with carrying costs that feel heavier than a grand piano. From financing hiccups to inspection nightmares, the reasons for collapse are as varied as Toronto’s neighborhoods. But don’t despair! With the right strategies and a dash of flexibility, you might just salvage that deal from the jaws of disaster. Stick around, and you’ll uncover the secrets to maneuvering this real estate rollercoaster.

Common Causes of Failed Closings

While a successful real estate deal is the goal, several common issues can derail the closing process in Toronto’s competitive market. You might think you’re in the home stretch, only to find yourself tripping over unexpected hurdles like a clumsy jogger on a crowded sidewalk.

Let’s face it, mortgage financing is about as reliable as a chocolate teapot. One minute you’re dreaming of your housewarming party, the next you’re drowning in a sea of rejection letters. It’s like playing financial Russian roulette – your approval isn’t guaranteed, and sudden changes in your bank account could leave you high and dry.

But wait, there’s more! Low appraisals can throw a wrench in the works faster than you can say “overpriced condo.” If the appraiser thinks your dream home is worth less than a cardboard box, you might find yourself scrambling to bridge the gap or watching your deal crumble like a stale cookie.

And don’t get me started on home inspections. You think you’ve found your perfect love nest, only to discover it’s secretly harboring more issues than a therapist’s couch. Structural damage, mold, or a family of raccoons living in the attic – suddenly, your dream home feels more like a nightmare on elm street.

Oh, and let’s not forget about those pesky title complications. Nothing says “welcome to homeownership” quite like discovering your property comes with more baggage than your ex. Unresolved liens or disputes can turn your closing into a never-ending story, leaving you wondering if you’ll ever get those house keys.

Financial Consequences of Deal Collapse

If you thought failed closings were a headache, just wait until you see the financial fallout they can release on unsuspecting buyers and sellers in Toronto’s real estate market. It’s like watching your hard-earned cash take a swan dive off the CN Tower, only to splatter dramatically on the pavement below. Ouch!

Let’s break down this financial horror show, shall we?

- Buyers, kiss your deposit goodbye

- Sellers, prepare for a legal rollercoaster

- Everyone, say hello to credit score carnage

First up, buyers. You know that earnest money deposit you put down? Yeah, that 5% (or more) of the purchase price you thought was just a formality? Well, it’s about to become your ex-money. Poof! Gone like your dreams of homeownership. And if you think that’s bad, buckle up, buttercup. The seller might decide to take you on a thrilling ride through the legal system, suing for breach of contract. Before you know it, you’re staring down the barrel of damages that make your initial deposit look like chump change. We’re talking potential six-figure losses here, folks.

But wait, there’s more! Your credit score might take a nosedive too, leaving future loan applications about as welcome as a skunk at a garden party. And sellers, don’t think you’re off the hook. You’ll be left holding the bag, frantically relisting your property and watching those carrying costs pile up like dirty dishes in a bachelor pad. Oh, and let’s not forget the cherry on top: legal fees that’ll have you questioning why you ever thought real estate was a good idea in the first place.

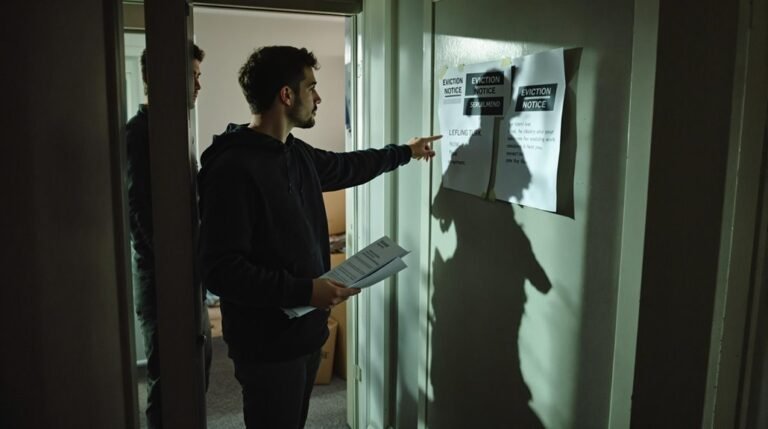

Legal Ramifications for Buyers

Backing out of a signed real estate deal in Toronto can land you in a legal minefield fraught with costly consequences. You might think you’re just changing your mind, but boy, oh boy, are you in for a rude awakening! It’s like trying to back out of a roller coaster after the safety bar’s locked – you’re in for a wild ride whether you like it or not.

First off, kiss that earnest money goodbye. You know, that hefty chunk of change you put down to show you’re serious? Well, now it’s the seller’s consolation prize for your fickleness. And trust me, 5% of a Toronto home price is no small potatoes – we’re talking enough to buy a small island… okay, maybe just a really fancy boat.

But wait, there’s more! If you bail after the subject period (that’s your get-out-of-jail-free card, folks), you might find yourself starring in your very own courtroom drama. And spoiler alert: the judges tend to side with the sellers. You could be on the hook for way more than just your deposit. It’s like going to an all-you-can-eat buffet, only to realize you’re the main course.

Now, if you’ve got a valid reason – like the house failing inspection or your mortgage falling through – you might be able to moonwalk your way out of this mess. But you’d better have proof, or you’ll be about as welcome in Toronto’s real estate scene as a skunk at a garden party. Remember, in this game, your reputation’s on the line. Choose wisely, or you might find yourself house-hunting in Siberia next time!

Seller’s Rights and Responsibilities

Now that we’ve seen how buyers can get tangled in a legal web, let’s flip the script and look at what sellers bring to the table in Toronto’s real estate game. Selling a house isn’t all rainbows and loonies, folks. You’ve got rights, sure, but you’re also juggling more responsibilities than a circus clown on a unicycle.

Let’s break it down into a tasty little list, shall we?

- The power of the almighty contract

- Show me the money (or at least the earnest deposit)

- Honesty is the best policy (no, really, it’s the law)

As a seller, you’re not just sitting pretty waiting for the cash to roll in. You’ve got the right to crack the whip if buyers try to weasel out without a good reason. Think of yourself as the bouncer at Club Closing – if they’re not on the list (of valid excuses), they’re not getting in. And if they do bail? Well, you might just get to keep that juicy earnest money deposit as a consolation prize.

But here’s the kicker: you can’t just sweep your property’s dirty little secrets under the rug. Nope, you’ve got to spill the beans on any defects or issues faster than a Toronto driver honking at a yellow light. Failure to disclose could land you in hotter water than a lobster at a seafood festival.

And let’s not forget about that pesky clear title business. It’s your job to make sure there are no legal hiccups or liens hanging around like uninvited guests at a house party. So, buckle up, buttercup – selling a house in Toronto is one wild ride!

Navigating Market Volatility Risks

Buckle up, Toronto homebuyers and sellers – you’re in for a rollercoaster ride through the city’s volatile real estate market. It’s like trying to play Jenga on a moving subway car: one wrong move, and your carefully laid plans come crashing down.

You’ve probably heard the whispers (or shouts) about a potential 12% price drop by early 2023. Yikes! That’s enough to make even the most stoic Torontonian break into a cold sweat. It’s as if the market decided to throw us all into a time machine back to 1981 – minus the big hair and shoulder pads.

Rising interest rates and those pesky federal stress tests are like uninvited guests at your housewarming party. They’re causing more buyers to back out of deals than a claustrophobic person in an elevator. We’re talking a 6% failure rate from March to July 2022. That’s not just a hiccup; it’s a full-blown case of real estate indigestion.

And let’s not forget about the foreign homebuyers tax. It’s like adding hot sauce to an already spicy market – sure to give everyone heartburn. With prices doing the cha-cha slide post-pandemic, buyers are getting cold feet faster than a barefoot walk on Lake Ontario in January.

Strategies to Salvage Troubled Deals

With the market’s mood swings giving everyone whiplash, you’ll need some ace strategies up your sleeve to keep your real estate deals from going sideways. Let’s face it, we’ve all been there – one minute you’re picking out curtains, the next you’re wondering if you’ll ever get the keys. But fear not, intrepid property seeker! There are ways to salvage that deal faster than you can say “contingency clause.”

First things first, communication is key. Keep those lines open like it’s the last payphone in a zombie apocalypse. Talking to your agent, the seller, and even your therapist (hey, we won’t judge) can help nip problems in the bud before they bloom into deal-breaking disasters.

Now, let’s talk contingencies. These little clauses are like your real estate safety net – they’ll catch you if things start to fall apart. Make sure you’ve got:

- A financing contingency (because who hasn’t had a last-minute money meltdown?)

- An inspection contingency (for when that charming fixer-upper turns out to be held together by duct tape and prayers)

- An appraisal contingency (because sometimes, love is blind – especially when it comes to property value)

If things still look dicey, don’t be afraid to ask for an extension. It’s like hitting the snooze button on your closing date – sometimes you just need a little more time to get things sorted. And if all else fails, get creative with your financing. Maybe your rich uncle wants to play bank for a day? Hey, stranger things have happened in this crazy market!

Professional Guidance in Crisis Management

When your real estate deal’s hitting turbulence, a pro’s steady hand can be your saving grace. Let’s face it, steering through the choppy waters of a property transaction crisis can feel like trying to guide a leaky rowboat through a hurricane. But fear not, fellow real estate adventurer! There’s a crew of experts ready to toss you a lifeline.

First up, your trusty real estate lawyer. They’re like the Rosetta Stone for contract hieroglyphics, deciphering those mind-numbing clauses and translating your legal rights into plain English. When you’re drowning in paperwork, they’ll be your buoy of sanity.

Next, consider enlisting a mortgage broker. These financial wizards can conjure up alternative funding options faster than you can say ‘denied application.’ If your mortgage falls through, they might just pull a rabbit (or a loan) out of their hat.

Don’t forget the eagle-eyed home inspector. They’re like a property psychic, spotting potential deal-breakers before they become full-blown crises. Trust me, you’d rather know about that ticking time bomb of a roof now than when it’s raining in your living room.

Your real estate agent is your market weather forecaster. They’ll help you read the wind and adjust your sails accordingly, whether you’re buying or selling.

Frequently Asked Questions

What Happens if a Real Estate Deal Falls Through in Ontario?

If your real estate deal falls through in Ontario, you’ll likely lose your deposit, typically 5% or more of the purchase price. You could face legal action, including being sued for damages. Proper documentation may protect you if conditions aren’t met.

Who Keeps the Deposit if a Real Estate Deal Falls Through?

When your dream home slips away, the deposit’s fate hangs in the balance. You’ll keep it if contingencies aren’t met or the seller drops the ball. But if you bail without cause, you’re likely kissing that money goodbye.

What Happens When a Buyer Breaches a Real Estate Contract in Ontario?

If you breach a real estate contract in Ontario, you’ll likely lose your deposit. You could face legal action for specific performance or damages. You may be liable for additional costs like carrying expenses and relisting fees.

What Happens if Financing Falls Through on a House in Canada?

Ahoy, matey! If your financing falls through on a house in Canada, you’ll likely lose your earnest money deposit. You’re off the hook if there’s a financing condition, but without it, you could face legal action for breach.

Conclusion

You’ve made it through the real estate roller coaster, and boy, what a ride! Remember, about 5% of deals in Toronto fall through, so you’re not alone in this nail-biting experience. Whether you’re the buyer licking your wounds or the seller cursing the market gods, take heart. With the right pros in your corner and a dash of resilience, you’ll weather this storm. Who knows? Your dream home (or buyer) might be just around the corner, waiting to make your property woes a distant memory.