Did you know that North York’s housing market has seen a 40% increase in rental prices over the past five years? This significant shift has left many residents grappling with the age-old question: to rent or to own? As you navigate this complex decision, you’ll need to take into account more than just monthly payments. Your lifestyle preferences, long-term financial goals, and the ever-changing real estate landscape all play pivotal roles in determining the best housing solution for you. The choice you make today could impact your financial future for decades to come, so it’s essential to understand all the factors at play.

Key Takeaways

- North York’s housing prices average $1.5 million for detached homes and $600,000 for condos, making renting a more affordable short-term option.

- Renting offers flexibility and predictable expenses, while homeownership builds equity and provides long-term investment potential.

- Homeowners face additional costs like property taxes and maintenance, but benefit from tax advantages and potential property appreciation.

- The rental market in North York has seen an 8% price increase, reflecting high demand and limited supply.

- Decision-making should consider financial goals, lifestyle preferences, and long-term plans for stability versus flexibility.

North York’s Real Estate Landscape

In light of North York‘s diverse housing market, you’ll find a range of options from million-dollar detached homes to more modest condo apartments, all amid a competitive landscape driven by high demand. As you explore the area’s real estate offerings, you’ll quickly notice the significant pricing trends that define the market.

Detached homes in North York command a premium, with an average price tag of around $1.5 million. These properties often appeal to families or individuals seeking more space and privacy.

On the other hand, if you’re looking for a more affordable entry into homeownership, condo apartments present a viable alternative, with average selling prices hovering around $600,000.

Your neighborhood preferences will play an essential role in your housing decision. North York offers a mix of urban and suburban environments, each with its own unique character and amenities. As you weigh your options, consider the proximity to public transit, schools, and local attractions that align with your lifestyle.

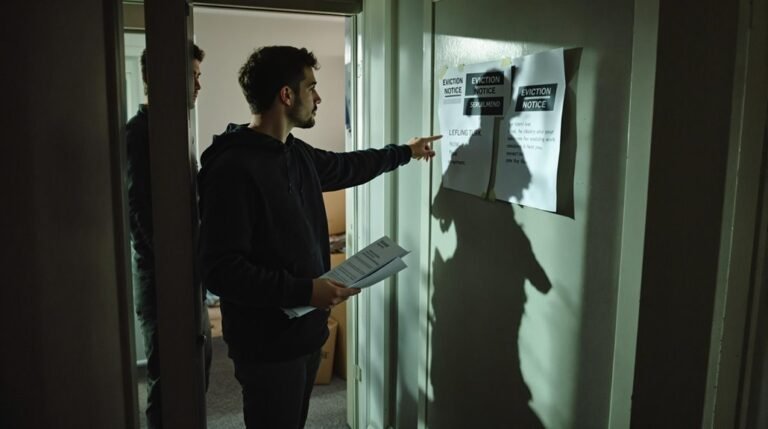

For those not ready to commit to homeownership, rental options abound in North York. However, be prepared for a competitive market, as demand for rental properties is high. This increased demand has led to a significant 8% rise in rental prices over the past year. As a prospective tenant, you’ll need to act quickly and decisively when you find a suitable property.

Whether you’re interested in luxury condos, single-family homes, or rental units, North York’s real estate landscape offers diverse property types to suit various needs and budgets. As you navigate this dynamic market, keep in mind that thorough research and expert guidance can help you make an informed decision.

Financial Considerations

When pondering housing options in North York, you’ll need to weigh three key financial factors: upfront expenses, ongoing costs, and long-term financial implications.

Let’s start with renting, where you’ll face an average monthly cost of $2,000 for a one-bedroom apartment. While this doesn’t require a significant initial investment, it’s important to conduct an affordability evaluation to ensure it fits within your budget.

On the other hand, homeownership in North York comes with significant initial expenses. With prices ranging from $800,000 to over $1 million for a detached home, you’ll need to plan for a substantial down payment. This requires diligent budget planning and setting clear savings goals. However, owning a home can offer long-term financial stability and potential property appreciation.

Your decision should also factor in ongoing costs. As a renter, you’ll have predictable monthly expenses, but you won’t build equity. Homeowners face variable costs like property taxes, maintenance, and potential mortgage rate fluctuations. It’s important to consider these when evaluating your financial stability.

The long-term implications of your choice are significant. Renting offers flexibility, which can be advantageous if you’re uncertain about your future in North York. Homeownership, while requiring a more substantial commitment, can provide a sense of security and potential financial growth.

Ultimately, your decision will depend on your personal financial situation, future plans, and risk tolerance. Carefully evaluate your budget, savings capacity, and long-term goals to make an informed choice in North York’s competitive housing market.

Lifestyle and Flexibility

How does your choice between renting and owning in North York impact your lifestyle and flexibility? This decision profoundly influences your daily life and future plans in this vibrant area of Toronto.

Renting in North York offers unparalleled flexibility, one of the key rental benefits. As a renter, you’re not tied down to a specific property or location. When your lease ends, you have the freedom to easily relocate to a different neighborhood or even a new city altogether. This flexibility is particularly advantageous if you’re uncertain about your long-term plans or if your career might require frequent moves.

On the other hand, owning a home in North York provides a sense of stability and roots in the community. You have the freedom to customize your living space without landlord restrictions, creating a home that truly reflects your personality and needs. However, this stability comes with increased responsibilities, such as property maintenance and repairs, which can impact your lifestyle and free time.

Renting also offers financial flexibility with fixed monthly costs, making budgeting more straightforward. You’re not responsible for property taxes or major repairs, which can free up your time and resources for other pursuits.

Homeownership, while potentially more financially demanding, offers the opportunity to build equity and invest in your future. It provides a sense of accomplishment and security that many find appealing.

Ultimately, your decision between renting and owning in North York should align with your lifestyle preferences, financial goals, and long-term plans. Consider your priorities carefully to make the choice that best suits your unique situation.

Long-term Investment Potential

Despite the initial costs, buying a home in North York can be a smart financial move due to its impressive long-term investment potential. When you purchase property in this area, you’re not just acquiring a place to live; you’re making a strategic investment in your future financial security.

North York’s real estate market has consistently demonstrated resilience and growth over the years. As a homeowner, you’ll benefit from steady property appreciation that outpaces inflation, allowing your investment to grow in value over time. This means that the money you put into your home today has the potential to yield significant returns in the future.

One of the key advantages of homeownership in North York is the opportunity for equity growth. As you pay down your mortgage and property values increase, you’ll build substantial equity in your home. This equity can serve as a valuable financial resource, whether you choose to leverage it for other investments or use it to fund major life expenses down the road.

The long-term investment potential of North York real estate extends beyond personal financial gain. By owning a home in this thriving area, you’re positioning yourself for greater financial security and wealth-building opportunities. As property values continue to rise, your investment becomes an increasingly valuable asset that can contribute to your overall financial portfolio.

In essence, while renting may offer short-term flexibility, owning a home in North York provides a solid foundation for long-term financial growth and stability. It’s an investment in your future that can pay dividends for years to come.

Maintenance and Responsibilities

Homeownership in North York comes with a set of responsibilities that you won’t face as a renter. As a homeowner, you’re accountable for all aspects of property upkeep and repairs, which can lead to unexpected and potentially costly expenses. This ownership burden includes tasks like lawn care, snow removal, and general upkeep to preserve your property’s value and longevity.

On the other hand, if you choose to rent, you’ll enjoy the benefits of tenant life. Landlord obligations cover most maintenance responsibilities, freeing you from the stress of property maintenance. This arrangement can be particularly appealing if you prefer a more hands-off approach to housing or if you’re not prepared for the financial commitment that comes with homeownership.

The extent of property maintenance can vary depending on the type of home you own in North York. Single-family homes typically require more extensive upkeep compared to townhouses or condos. As a homeowner, you’ll need to budget for regular maintenance and be prepared for unforeseen repairs that may arise.

While homeownership offers long-term investment potential, it’s essential to take into account the ongoing costs associated with maintenance. These expenses can have a significant impact on your overall financial picture. Renters, however, can allocate the money they save on upkeep towards other investments or lifestyle choices.

Ultimately, your decision to rent or own in North York should take into account your willingness to take on property maintenance responsibilities. Reflect on your lifestyle, financial situation, and long-term goals when weighing the pros and cons of each option.

Tax Implications

North York’s tax landscape presents unique considerations for both homeowners and renters, affecting your long-term financial outlook. As you weigh the decision to rent or buy, it’s essential to understand the tax implications of each option.

If you’re a homeowner in North York, you’ll find several tax benefits that could work to your advantage. One notable perk is the Principal Residence Exemption, which may allow you to avoid capital gains tax when selling your home. Additionally, you might be able to deduct mortgage interest from your taxes, potentially reducing your overall tax burden. These homeowner advantages can contribute to building long-term wealth and financial stability.

However, it’s important to note that property taxes in North York can be a substantial expense. As a homeowner, you’ll need to factor this recurring cost into your budget. While these taxes support local services and infrastructure, they can significantly impact your monthly expenses.

On the flip side, if you’re renting in North York, you won’t have to worry about property tax payments directly. This can simplify your financial planning and potentially free up funds for other investments or savings goals. However, you’ll miss out on the tax benefits associated with homeownership.

Ultimately, your decision to rent or own in North York should take these tax implications into account. Consider consulting with a financial advisor or tax professional to fully understand how each option aligns with your personal financial goals and circumstances.

Market Trends and Forecasts

As you navigate North York’s housing market, it’s vital to understand the current trends and future projections that’ll shape your decision-making process. The real estate landscape in North York is marked by high property values and a dynamic rental market, presenting both challenges and opportunities for prospective buyers and renters alike.

Currently, detached homes in North York command an average price of $1.4 million, while condo apartments hover around $705,572. These steep prices have led to increased rental demand, as many residents find themselves priced out of the ownership market. The rental market has responded with significant price increases over the past quarter, reflecting the growing competition for available units.

Looking ahead, the rental market in North York is likely to remain strong, driven by continued population growth and limited housing supply. This trend suggests potential investment opportunities for those considering purchasing property as a rental income source. However, it’s essential to weigh the high entry costs against potential returns.

For renters, the current pricing trends indicate that locking in a lease sooner rather than later might be advantageous, as rates are expected to continue climbing. On the other hand, prospective buyers should carefully consider the substantial financial commitment of homeownership, including property taxes, condo fees, and insurance, against the flexibility and predictability of renting.

Ultimately, your decision to rent or buy in North York will depend on your financial situation, long-term goals, and risk tolerance. Keep a close eye on market trends and consult with local real estate professionals to make an informed choice.

Decision-Making Strategies

When it comes to maneuvering North York’s housing dilemma, you’ll need to employ strategic decision-making techniques to weigh your options effectively. The first step in your decision-making process should be a thorough pros and cons analysis of renting versus buying in this competitive market.

Start by considering the financial aspects. With the average detached home price in North York hovering around $1.5 million, you’ll need to evaluate if you’re ready for such a significant investment. Factor in additional costs like property taxes, insurance, and maintenance expenses when calculating the true cost of ownership.

On the flip side, analyze the current rental market trends, noting that prices are on the rise despite increased apartment construction.

Next, consider the flexibility that renting offers versus the long-term benefits of homeownership. While renting allows for more mobility, buying a property in North York could be a wise investment, as values tend to appreciate over time. Use comparison strategies to determine which option aligns better with your lifestyle and future plans.

To make an informed decision, create a detailed budget that accounts for both scenarios. Include potential mortgage payments or rent, utilities, and savings goals. Don’t forget to factor in the opportunity cost of using your savings for a down payment instead of investing elsewhere.

Ultimately, your decision to rent or buy in North York will depend on your personal circumstances, financial situation, and long-term goals. By employing these decision-making strategies and carefully weighing the pros and cons, you’ll be better equipped to navigate North York’s housing dilemma and make the choice that’s right for you.

Conclusion

You’re faced with a complex choice: the freedom of renting versus the stability of owning.

While you’ll avoid maintenance headaches as a renter, you’ll miss out on building equity. Homeownership offers potential financial growth, but it ties you down.

North York’s dynamic market adds another layer of uncertainty. Weigh your personal goals against market trends, and don’t forget to contemplate tax implications. Ultimately, your decision will shape your lifestyle and financial future.

Whether you’re contemplating the flexibility of renting or the long-term benefits of homeownership, making the right choice requires expert guidance. At Realtor North York – The Fan Team, our experienced real estate agents are here to help you every step of the way.

Don’t leave your future to chance. Contact The Fan Team today to schedule a consultation and let us guide you toward the best housing solution for your unique needs. Let’s turn your dreams into reality in North York’s vibrant real estate market!