Renters insurance in North York offers essential protection for your belongings and financial security. You’ll get coverage for theft, fire damage, and liability claims with policies starting around $38 per month. Most tenants need at least $30,000 in coverage to protect their average $20,000 worth of personal items. Top providers like Apollo Insurance, Square One, RBC, and Intact offer competitive rates and customizable policies. You can save up to $110 annually by comparing quotes through platforms like RATESDOTCA. Quick claim filing and proper documentation guarantee successful compensation within 30 days. This guide will show you how to secure the best coverage for your needs.

Key Takeaways

- North York renters typically need $30,000 minimum coverage, with average monthly premiums around $38 for basic protection.

- Leading providers include Apollo Insurance, Square One Insurance, RBC Insurance, and Intact Insurance, each offering unique coverage benefits.

- Basic coverage protects against theft, fire damage, personal liability, and provides additional living expenses during temporary displacement.

- Policy exclusions include floods, earthquakes, intentional damage, and criminal activities, requiring optional coverage for specific risks.

- Residents can save money through online quote comparisons, higher deductibles, policy bundling, and maintaining good credit scores.

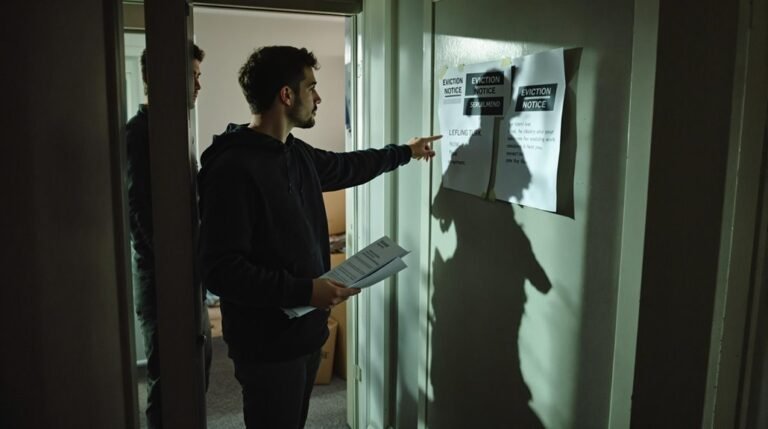

Why North York Renters Need Insurance

Nearly every North York renter faces potential risks that could impact their financial security and personal belongings. With 46% of residents renting, this protection becomes increasingly important for a large portion of the population. You’ll find renters insurance provides vital protection against these risks through multiple coverage types. The average tenant has $20,000 worth of personal belongings to protect.

Your personal belongings receive thorough protection from theft, fire damage, and other covered perils. The insurance covers repair or replacement costs for damaged items inside your rental unit. You’ll also get coverage for belongings stored in other locations like your car or storage unit. With rental prices surging in North York, protecting your assets becomes even more crucial.

The liability coverage protects you in three key ways:

- Pays legal expenses if someone sues you for injuries in your rental unit

- Covers medical costs for guests who get injured on your property

- Handles damage you accidentally cause to others’ property

Additional living expenses coverage becomes essential if your rental unit becomes uninhabitable. You’ll receive compensation for:

- Temporary housing costs like hotel stays

- Extra meal expenses

- Other necessary living costs until you can return home

Many North York landlords now require renters insurance as part of the lease agreement. At around $31 per month, this coverage proves more affordable than most renters expect. You can often reduce costs through:

- Policy bundling discounts

- Good credit score benefits

- Safety feature installations

Without renters insurance, you’re financially vulnerable to accidents, theft, and property damage. The coverage safeguards your finances and guarantees you won’t face overwhelming costs from unexpected events.

Understanding Your Coverage Options

Toronto renters who understand their insurance coverage options make better decisions protecting their assets. Your standard renters insurance policy includes several key types of protection you’ll need to understand.

Here’s what your basic coverage typically includes:

- Contents Coverage protects your personal belongings from theft, damage, or loss.

- Liability Coverage helps with legal costs if someone gets hurt in your rental unit.

- Additional Living Expenses cover temporary housing if your rental becomes uninhabitable.

Most landlords require tenants to have at least $30,000 in coverage.

You’ll find certain limitations in standard policies. Most don’t cover flood or earthquake damage, but you can add these through optional endorsements. Criminal activities and damage from poor maintenance aren’t covered either. Regular reviews of your policy are recommended after significant property changes or renovations.

You can customize your policy in several ways:

- Choose between an All-Risks Policy that covers everything except listed exclusions.

- Select a Named Perils Policy that covers only specific listed events.

- Add a Personal Articles Floater for valuable items like jewelry or art.

- Adjust your deductible to balance premium costs with out-of-pocket expenses.

When filing a claim, you’ll need to:

- Provide proof of damage through photos or documentation.

- Work with an insurance adjuster who’ll inspect the damage.

- Submit required paperwork promptly.

Your policy may also include temporary coverage for belongings while they’re away from home.

Consider additional endorsements if you need extended coverage for specific items or situations. Remember that home business activities require separate business insurance coverage.

Cost Factors in North York

Several key factors drive renters insurance costs in North York, making it one of Ontario’s most expensive areas for tenant coverage. The location’s high crime rates and history of natural disasters contribute greatly to premium costs. You’ll also find that your specific neighborhood or ZIP code within North York can affect your rates. Most residents pay around $170 per year for basic coverage, which is comparable to a monthly cell phone bill. Getting quotes under a minute through online platforms makes it easy to compare rates from different providers.

Your coverage choices play a major role in determining costs. Here are the main factors that influence your premiums:

- Personal belongings coverage: Higher coverage limits for valuable items will increase your rates.

- Liability protection: This mandatory coverage protects you if someone gets injured in your rental unit.

- Additional living expenses: Coverage for temporary housing if your unit becomes uninhabitable.

- Building characteristics: The age and condition of your rental property affect your rates.

- Security features: Having proper safety measures can help reduce your insurance costs.

Your deductible choice will directly impact your monthly payments. You’ll need to decide between paying higher monthly premiums with a lower deductible or lower premiums with a higher deductible. Most insurance providers offer various deductible options to fit your budget.

The value and type of contents in your rental unit will affect your rates. You’ll want to take into account factors like:

- The total worth of your belongings.

- Any high-value items requiring extra coverage.

- Security systems or safety features in your unit.

- Your personal insurance history and credit score.

These elements combine to determine your final insurance costs in North York’s competitive rental market.

Choosing the Right Insurance Provider

Finding the right insurance provider in Toronto requires careful evaluation of coverage options, rates, and company reliability. You’ll need to assess multiple factors to make an informed decision for your rental property protection. Monthly payments of $38 on average help protect your belongings in North York.

Start by examining the essential coverage components:

- Protection for your personal belongings against theft and damage

- Liability coverage for accidental injuries or property damage

- Additional living expenses if your unit becomes uninhabitable

- Optional coverage for valuable items like jewelry and art

Toronto offers several reputable insurance providers. Apollo Insurance features a user-friendly online platform with extensive coverage including flood protection. Square One Insurance lets you customize your policy based on your specific needs. RBC Insurance provides broad coverage options with loyalty benefits for bundled policies. Intact Insurance stands out with competitive rates and identity theft protection. Most providers offer instant document delivery through email for immediate proof of coverage.

You can save money by comparing quotes online. The average Toronto tenant pays $248 annually for insurance. Recent data shows shoppers saved an average of $110 in 2023 through quote comparisons on RATESDOTCA. You’ll find additional discounts for good credit scores and policy bundling.

Don’t forget to verify insurer reliability:

- Read customer reviews about claims and service quality

- Check ratings from multiple sources

- Confirm easy access to policy documents

- Research the company’s market experience

Consider providers like Apollo Insurance, which maintains a 4.7 rating from over 2,000 reviews, demonstrating strong customer satisfaction and reliable service.

Filing Insurance Claims Successfully

Success in filing a renters insurance claim depends on quick action and thorough documentation. You’ll need to follow specific steps to guarantee your claim gets processed efficiently and effectively in Toronto’s rental market. The average claim process takes around 30 days to complete for standard cases.

Start by notifying all relevant parties immediately after an incident occurs. Contact your insurance provider first. If there’s criminal activity involved, call the police and get a report. You should also inform your landlord about the situation. For fire-related incidents, contact the fire department right away. Having a support ID number from each agency will help track your case effectively.

Document everything thoroughly with these key steps:

- Take clear photos and videos of all damaged items

- Create a detailed inventory list of affected belongings

- Gather original receipts or proof of purchase

- Keep records of any emergency repairs

- Save all communication with involved parties

When submitting your claim, you’ll need to:

- Complete the insurance company’s claim form accurately

- Provide all requested documentation

- Submit your evidence including photos and receipts

- Sign any required statements or proof of loss forms

You’ll work with an insurance adjuster who’ll evaluate your claim. The adjuster will:

- Review your policy coverage

- Inspect the damage

- Determine if exclusions apply

- Calculate your payment based on actual cash value or replacement cost

Remember to maintain copies of everything you submit. Don’t dispose of damaged items until the adjuster has completed their inspection.

Stay in regular contact with your insurance company throughout the process to guarantee smooth claim processing.

Common Insurance Policy Exclusions

Your renters insurance policy won’t cover everything, so it’s essential to understand what’s excluded before you need to make a claim.

The main exclusions fall into four key categories:

- Damage and Neglect Exclusions

- Intentional damage or criminal acts

- Natural wear and tear (fading paint, scuffed floors)

- Water damage from frozen pipes due to poor maintenance

- Property left vacant for over 30 days

- Mould from inadequate home care

- Natural Risks and Events

- Earthquake damage (unless added as optional coverage)

- Flood damage (available as an add-on)

- Pest infestations including termites and bed bugs

- War and terrorism

- Nuclear hazards and radiation

- Business and Personal Items

- Business equipment and related losses

- Home business activities

- Vehicle contents

- Roommates’ belongings unless named on policy

- Personal liability outside geographical limits

- External Factors and Property

- Detached structures like sheds (unless specifically included)

- Government property seizure

- Landlord’s possessions

- Damage from leaving property unmonitored

- Mould from uninsured perils

Understanding these exclusions helps you make informed decisions about additional coverage you might need.

High-value items like jewelry and electronics often require separate endorsements due to standard policy limits.

Despite exclusions being common, tenant insurance costs typically range between $200-500 annually, making it an affordable investment.

Consider purchasing extra protection for specific risks that aren’t covered by your standard policy.

Remember that some excluded perils can be added through optional coverage or separate insurance policies.

Always review your policy details carefully to know exactly what protection you have.

Protecting Your Valuable Items

Protection of valuable items requires careful planning and specific insurance considerations when you’re renting in Toronto. Standard renters insurance mightn’t fully cover your collectibles, jewelry, or fine art. You’ll need to understand your policy’s limits and exclusions to guarantee proper coverage. Online quotes can help you obtain coverage in under a minute for basic policies. Monthly premiums must be paid to maintain continuous protection. Housing market trends indicate a growing need for comprehensive renters insurance in urban areas.

Follow these steps to protect your valuable items:

- Create a detailed inventory of all your belongings

- Document the value of each significant item

- Update your inventory regularly as you acquire new items

- Keep records and photos of valuable possessions

- Work with an insurance advisor to determine coverage needs

Your standard policy may have insufficient limits for extensive collections. You can enhance your protection through these additional coverage options:

- Separate collectibles insurance for specific items

- Valuable items riders for jewelry and artwork

- Replacement cost coverage for full-value compensation

- Additional living expense coverage if damage occurs

When filing claims, you’ll need proper documentation. Make certain you:

- Understand your policy terms completely

- Keep receipts and appraisals accessible

- Maintain photo evidence of valuable items

- Document item conditions regularly

Don’t underestimate replacement costs when selecting coverage. Your policy should include at least $1 million in liability protection.

If you have significant collections or high-value items, consider specialized coverage beyond your standard renters insurance. Regular policy reviews will help guarantee your coverage stays current with your changing needs.

Getting the Best Insurance Rates

Getting affordable renters insurance in Toronto depends on knowing how to navigate the market effectively. You’ll find several proven strategies to secure the best possible rates for your rental coverage.

Start by comparing multiple insurance quotes through online platforms like Ratehub.ca and InsuranceHotline.com. These tools let you quickly assess different options and identify the most competitive rates. Companies like Square One Insurance offer customizable tenant policies that can help you find the perfect coverage fit.

Don’t forget to check direct insurer websites as they sometimes offer better deals. APOLLO Insurance provides instant quotes and policy purchases in under a minute.

Bundling your insurance products is another effective way to save money. Consider combining your tenant insurance with auto insurance or other policies under one provider. Companies like RBC Insurance offer substantial discounts for bundled coverage. With the current 1.5% vacancy rate in Toronto, securing comprehensive coverage is more important than ever.

This approach often results in lower overall premiums while maintaining thorough protection.

You can reduce your insurance rates by implementing these key safety measures:

- Install a monitored alarm system

- Keep fire extinguishers in your rental unit

- Maintain proper safety equipment

- Follow your insurer’s recommended security guidelines

Managing your insurance record properly plays a vital role in securing better rates. Avoid filing small claims that could increase your premiums in the long run.

Insurance companies view clients with clean records as lower-risk customers. This clean history often leads to better rates and additional discounts.

Remember to check with local insurance providers who may offer special deals for Toronto residents. These companies understand the specific needs of the area and might provide more tailored coverage options at competitive rates.

Working With Insurance Brokers

While finding competitive rates is important, partnering with an insurance broker can elevate your search for the right coverage. Insurance brokers compare quotes from multiple providers to help you find the best fit for your needs and budget. They’ll guide you through complex policy details and explain coverage options in clear terms. Our research shows that Toronto residents pay around $180.73 annually for basic coverage. The month-to-month structure offers flexibility without long-term commitments.

Working with a broker offers several key advantages:

- You’ll get access to customized coverage options that match your specific requirements.

- Brokers provide extensive market knowledge to help you make informed decisions.

- They assist with claims processing to guarantee fair and efficient handling.

- You’ll receive help with landlord notifications and lease compliance.

The process of working with a broker is straightforward. Modern brokers offer user-friendly online platforms where you can get quotes in minutes. You’ll simply answer questions about your property and personal information to receive accurate estimates. Their digital tools make it easy to customize your coverage and manage documentation online.

Your broker can help you secure essential coverage including:

- Contents protection for your belongings.

- Personal liability coverage up to $2,000,000.

- Additional living expenses coverage.

- Special limits for valuable items like jewelry.

- Extensions for property in vehicles or other locations.

They’ll guarantee your policy meets all landlord requirements and local regulations. You can also add immediate family members or romantic partners to your policy if needed.

With a broker’s expertise, you’ll navigate the insurance process efficiently while maintaining complete lease compliance.

Conclusion

You’ll find that renters insurance in North York provides essential protection for your belongings and liability coverage. Take time to compare policies from different providers and understand your coverage options fully. Document your possessions, keep important policy information accessible, and stay current with your premium payments. Working with a licensed broker can help you secure the best rates and guarantee you’ve got appropriate coverage for your specific needs.