Toronto’s rental market in 2025 will face significant changes due to planned immigration of 1.5 million newcomers and historically low vacancy rates of 1.5%. You’ll see rental prices rise 6-8% in key areas as demand outpaces supply. North York remains a prime investment zone with strong rental demand. Government initiatives aim to create 65,000 rent-controlled homes by 2030. The market’s complex dynamics offer both challenges and opportunities for those seeking deeper insights.

Key Takeaways

- Rental prices are projected to rise 6-8% in key Toronto areas, with average one-bedroom apartments costing $2,452 in 2024.

- Toronto’s vacancy rate remains historically low at 1.5%, indicating strong rental demand driven by immigration and population growth.

- Government initiatives aim to create 65,000 rent-controlled homes by 2030 through the HousingTO Plan and development incentives.

- Expected interest rate cuts to 4.25% by 2025 may improve investment conditions and increase rental property availability.

- North York emerges as a prime investment area with 1.6% vacancy rates, while Scarborough and Brampton show high rental demand.

What’s Driving Toronto’s Rental Price Increases?

Toronto’s rental price increases stem from a complex interplay of market forces, with housing supply and demand leading the charge.

Market dynamics shape Toronto’s rental landscape, where limited housing supply clashes with growing demand to drive prices higher.

You’ll find the primary drivers fall into two main categories: economic and market-related factors.

The main factors pushing prices up include:

- Persistent housing supply shortages despite new rental construction

- Strong rental demand from population growth and immigration

- High interest rates affecting potential homebuyers who continue renting

- Limited vacancy rates below long-term averages

- Unrestricted pricing for new tenants

While rent control caps increases at 2.5% for 2025, landlords can set any price when units become vacant.

This creates pressure in the market. Despite government cuts to temporary residents, early 2025 showed a 14% increase in leased units compared to 2024. The surge in purpose-built rentals may help stabilize prices.

Zoning restrictions in areas like North York continue to prevent higher-density developments, further limiting available housing inventory.

However, rental affordability remains strained due to the gap between supply and demand.

Employment growth and shifting housing preferences continue to fuel rental demand across Toronto’s neighborhoods. Recent data shows Toronto has experienced lagged rent growth compared to other major Canadian cities.

How Immigration Impacts Toronto’s Rental Market

Toronto’s rental demand directly connects to its rapidly growing population through immigration.

You’ll notice this impact most clearly in the government’s plan to welcome 1.5 million new immigrants by 2025, with many choosing to settle in the Greater Toronto Area.

The surge of newcomers creates additional pressure on an already tight rental market, leading to increased competition for available units and higher rental prices across the city. Areas like Scarborough and Brampton are experiencing particularly high rental demand from immigrant communities.

With a current vacancy rate of 1.5%, the market is experiencing its tightest conditions since 1988, further intensifying the competition for available units.

Recent data shows a potential easing of this pressure as population decline of 0.4% is projected due to new government measures.

Population Drives Rental Demand

As immigration continues to shape Canada’s largest city, the rental market faces unprecedented demand from newcomers seeking housing. Toronto’s population growth is driven 98% by immigration, creating intense competition for rental units.

You’ll find the highest rental demand in areas like Scarborough, Brampton, and North York. These neighborhoods attract newcomers due to established immigrant communities and improved infrastructure. The recent reduction to 395,000 permanent residents by 2025 may provide slight relief to these high-demand areas.

In 2025, expect rental prices to increase by 6% to 8% in these key areas.

The average one-bedroom apartment now costs $2,452 in Toronto. Despite increased condo rental listings and new high-rise developments, vacancy rates remain low. The city’s vacancy rate low of 1.5% marks a 35-year record.

Transit-oriented developments are becoming popular investment options as the city expands. Even with adjusted immigration targets, the rental market continues to show strong demand and steady growth.

Immigration Boosts Housing Scarcity

While increased immigration drives economic growth, it also intensifies housing scarcity across the Greater Toronto Area.

You’ll notice this impact most strongly in popular immigrant communities like Scarborough and North York, where rental demand continues to surge.

Here’s how immigration affects Toronto’s rental market:

- Federal immigration targets create additional pressure on housing supply

- New immigrants often compete for rentals in specific neighborhoods

- High demand pushes rental prices up in immigrant-heavy areas

- Suburban areas like Brampton see spillover effects

- Recent policy changes may offer some relief

Most new immigrants choose to rent initially, with rental household creation accounting for approximately 85% of total immigrant households.

You’ll find temporary residents have decreased considerably in 2025. The projected GDP growth decline to around 1% suggests a potential easing of housing pressures.

This shift could stabilize rental prices in certain areas. However, the overall need for affordable housing remains a pressing challenge as the city works to increase supply through denser developments.

The Role of Interest Rates in Rental Market Dynamics

Interest rate changes directly affect your rental market experience through their impact on property investment and monthly payments.

The Bank of Canada’s move to 3.25 percent rates has created more favorable conditions for property investors.

North York’s rental yield rates of 3-4% continue to provide stable income opportunities for property investors.

You’ll notice that when interest rates drop, more investors enter the rental market because they can secure better financing terms for property purchases.

The lower rates also influence your landlord’s financing decisions, potentially leading to more stable rent prices as their mortgage costs decrease.

The anticipated housing market recovery in 2025 is expected to gradually ease rental demand as more Canadians transition to homeownership.

Rate Cuts Drive Investment

The anticipated rate cuts in 2025 will drive significant changes in Toronto’s rental market. You’ll see interest rates drop to around 4.25%, making rental property investments more attractive and financially viable. This shift will particularly impact purpose-built rental developments in transit-connected areas and downtown Toronto.

- Your investment opportunities will expand as lower rates make previously unfeasible projects possible.

- You’ll notice increased competition from other investors seeking strong rental yields.

- Your potential returns will improve as rental prices continue rising 6-8% in key areas.

The lower rates will create new opportunities in suburban areas where infrastructure improvements are making properties more desirable. Federal incentives like GST waivers will further support purpose-built rental developments.

These factors combine to maintain a robust investment environment despite market changes.

Monthly Payment Affordability Trends

Many Toronto renters face evolving affordability challenges as monthly payments shift with market conditions.

You’ll see one-bedroom apartments averaging $2,452 per month with projected increases of 6% to 8% in key areas.

The current interest rate of 4.25% affects the market in several ways:

- Lower rates make mortgages more affordable for investors

- This can increase rental supply as more investors enter the market

- High construction costs still limit new development growth

Population growth continues to drive demand up. Immigration, international students, and young professionals keep vacancy rates low.

Ontario’s 2.5% rent control cap offers some protection for existing tenants. The city’s goal to create 40,000 affordable units by 2030 may provide relief.

However, strong rental demand and limited supply continue to push monthly payments higher.

Landlord Financing Decisions

Shifting market conditions create significant opportunities for landlords making financing decisions in Toronto’s rental landscape. Lower interest rates enable property owners to refinance existing mortgages and expand their portfolios strategically.

You’ll need to balance these opportunities with regulatory requirements and market risks.

- You can improve cash flow by refinancing your properties when rates drop.

- You’ll find more viable investment opportunities as lower borrowing costs make projects feasible.

- You must consider long-term sustainability when planning new acquisitions.

Your financing decisions should account for rent control policies and zoning requirements in Toronto. Real-time market data will help you make informed choices about property investments.

Remember that while lower rates create opportunities, you’ll need to prepare for potential future rate increases. Consider both urban and rural market dynamics when expanding your portfolio.

Key Market Indicators for Rental Property Investors

When evaluating Toronto’s rental market, investors must focus on several critical indicators that signal investment potential.

Look for these key market signals:

- Population Growth: Strong immigration and international student influx continue driving rental demand despite cooling population growth in 2025.

- Rent Prices: Expect 6-8% increases in key areas with one-bedroom units averaging $2,452 monthly. Purpose-built rentals will see 3-4% growth.

- Vacancy Rates: Low vacancy rates indicate strong rental demand and competitive tenant markets.

- Development Plans: Watch for 7,000 new rental homes including 5,600 purpose-built units by 2026.

- Interest Rates: Lower rates in 2025 will improve mortgage affordability for investors.

- Investment Competition: Properties under $1 million face intense investor competition but offer strong cash flows.

- Supply Indicators: Condo rental listings have increased 51.3% showing shifting market preferences.

These indicators help you make informed investment decisions in Toronto’s dynamic rental market.

Investors should note that affluent tech workers now account for 60-70% of Toronto’s real estate purchases, significantly influencing rental market dynamics.

Understanding North York’s Low Vacancy Rates

North York’s low vacancy rate of 1.6% reflects the intense competition you’ll find in today’s rental market.

You’ll notice this competitive environment stems from strong population growth and steady immigration patterns that continue to drive rental demand.

Your search for rental properties will be affected by these market conditions, which contribute to the projected 6-8% price increases in key areas.

With average rent at North York units reaching $2,402, competition is especially fierce for rent-controlled properties occupied before November 2018.

Rental Demand Driving Forces

Understanding Toronto’s rental demand requires examining several key factors driving North York’s remarkably low vacancy rates.

Population growth and strong immigration policies create constant pressure on rental housing. The influx of international students and professionals adds another layer of demand. High interest rates keep many potential homebuyers in the rental market longer than planned.

- You’ll notice a significant impact from newcomers who often prefer rentals as their first housing option.

- You’ll see how rising interest rates have forced many young professionals to continue renting.

- You’ll understand why international students create year-round demand for rental units.

Economic growth and demographic shifts continue to shape the rental landscape. The combination of job market strength and infrastructure improvements makes North York particularly attractive to renters.

Digital technologies have made finding and managing rental properties more efficient.

Competition Among Property Seekers

Intense competition marks the rental landscape in North York, where a remarkably low 1.6% vacancy rate creates a challenging environment for property seekers.

You’ll find yourself competing against a growing population of renters driven by strong immigration and urban living preferences.

The rental market shows these competitive characteristics:

- Apartments dominate available listings at 77.14% of total inventory

- Two-bedroom units attract the highest demand among family seekers

- Price increases of 6-8% are expected in key areas

- Limited housing supply fails to meet the growing demand

- Seasonal fluctuations affect availability but vacancy rates stay consistently low

These factors combine to create a landlord’s market where multiple applicants often compete for each available unit.

Your success in securing a rental depends on quick action and strong applications.

Market Impact on Prices

With vacancy rates hitting a historic low of 1.6%, rental prices in North York continue to climb steadily.

You’ll find average rents reaching C$2,661 as competition intensifies among renters. The market shows clear signs of pressure from population growth and immigration influx.

The current market conditions affect prices in several significant ways:

- Low vacancy rates drive monthly rents up by limiting available options

- Immigration and student influx create constant demand pressure

- Property investors face higher acquisition costs which transfer to rental rates

You can expect further price increases of 6-8% in key Toronto areas.

The Industrial area presents an exception with a 13% decrease in rates.

New development projects aim to add inventory but won’t likely meet immediate demand.

Current market dynamics strongly favor landlords over tenants.

New Development Projects and Their Market Impact

Toronto’s ambitious development plans are reshaping the rental market landscape through several major initiatives.

You’ll see up to 16,000 purpose-built rental homes entering the market with 4,000 designated as affordable housing units.

These developments will impact the market in three key ways:

- The supply increase of 20,000 new rental units will help meet growing housing demand.

- Rental prices may stabilize or decrease due to increased housing availability.

- Local economic growth will benefit from construction jobs and improved housing affordability.

Developers can access significant incentives including reduced development charges and property tax breaks.

All projects must begin construction by the end of 2026 to qualify for these benefits.

The city’s first public developer project at 11 Brock Ave showcases this initiative.

It features rent-geared-to-income homes with shared amenities and demonstrates Toronto’s commitment to addressing housing needs through strategic development.

The Housing Now initiative represents a major step toward creating 65,000 new rent-controlled homes by 2030.

International Students and Rental Demand Patterns

Recent shifts in international student enrollment have dramatically reshaped Toronto’s rental market dynamics. The federal government’s cap on international admissions has cut enrollment by nearly half in Ontario. This significant decrease has led to noticeable changes in rental demand patterns across Toronto’s neighborhoods.

You’ll find rental prices ranging from $2,200 to $2,800 for one-bedroom apartments in Toronto. International students often choose shared accommodations to manage these high costs. University housing offices can help you navigate the rental market and understand your tenant rights.

- You must start your housing search early to secure affordable options near universities.

- You’ll need to budget carefully as Toronto’s rental costs remain among Canada’s highest.

- You should consider homestay programs or shared housing to reduce your monthly expenses.

The market continues to adjust to these enrollment changes while maintaining its competitive nature in prime locations near educational institutions.

income-based subsidies could provide relief for students struggling with Toronto’s rising rental costs, similar to programs currently supporting senior residents.

Investment Opportunities in Toronto’s Rental Market

The rental market’s evolving landscape offers compelling investment opportunities for property buyers in Toronto. You’ll find several property types that can deliver strong returns through rental income and appreciation.

Consider these top investment options for 2025:

- Multiplexes provide multiple rental income streams and show better resistance during economic downturns.

- Semi-detached homes remain stable investments due to their affordability and consistent demand.

- Pre-construction condos offer entry points into the market at potentially lower prices.

- Houses with conversion potential can be transformed into multiple units for higher rental yields.

You’ll need to prepare for substantial down payments (typically 20%) and factor in maintenance costs.

The anticipated market recovery in 2025 combined with Toronto’s population growth creates favorable conditions for investors.

Look for properties in up-and-coming areas where you can benefit from future appreciation and steady rental demand.

North York presents particularly strong investment potential with low vacancy rates of 1.6% ensuring consistent rental income potential.

Supply vs. Demand: Current Market Analysis

Market dynamics in Toronto’s rental sector have shifted dramatically, creating an oversupply situation that favors tenants.

You’ll find more rental options available as new condo completions enter the market and investors list their properties for lease. This increased inventory comes at a time when demand is decreasing due to reduced immigration targets and slower population growth.

Current market conditions are causing notable changes:

Market shifts create significant changes as Toronto’s rental landscape transforms, giving tenants newfound advantages in a shifting economy.

- Rental prices are declining for the first time in over 20 years giving tenants more negotiating power.

- Landlords face increased competition with record-high rental listings heading into 2025.

- Property investors are selling small condos adding to the available inventory.

The future outlook suggests a more balanced market as supply and demand adjust.

Interest rates remain favorable for landlords though rental income may continue to face pressure.

You’ll see ongoing market adjustments as economic conditions and government policies evolve throughout 2025.

The sales-to-new-listings ratio of 41% indicates a clear shift toward a buyer-friendly market environment.

Government Initiatives Shaping Rental Housing

While supply and demand continue shaping market conditions, significant government action now steers Toronto’s rental landscape in new directions.

The city has launched major initiatives to boost rental housing supply through three key programs:

- The Purpose-Built Rental Housing Incentives stream aims to create 20,000 new rental homes by offering development charge deferrals and property tax reductions.

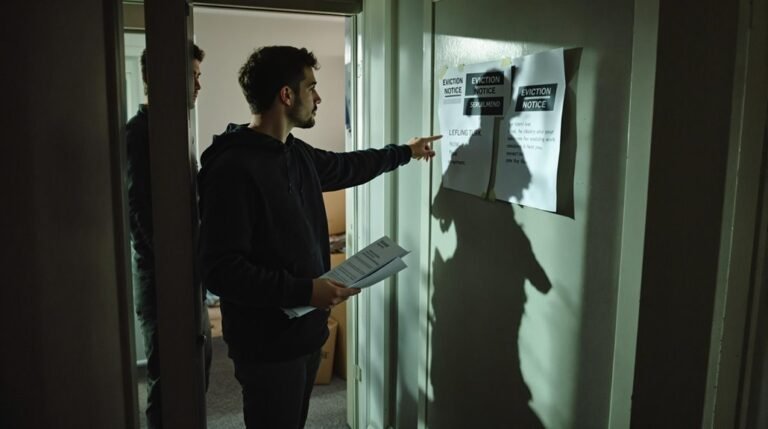

- A new Rental Renovation Licence Bylaw will protect you from renovictions starting in 2025. This law guarantees landlords can’t displace tenants through unnecessary renovations.

- The HousingTO Plan targets 65,000 rent-controlled homes by 2030, including 6,500 rent-geared-to-income units.

You’ll see $461.1 million in city funding supporting these initiatives.

The government’s also creating a Centralized Affordable Rental Housing Access System to help you find affordable units more easily.

Additional support comes through expanded Rent Bank funding and updated eviction prevention resources.

The city’s affordable housing initiatives received a substantial boost with $351 million allocated specifically for rental housing projects aimed at creating nearly 6,000 new homes.

Conclusion

Toronto’s rental market in 2025 presents both challenges and opportunities you’ll need to understand. Rising immigration, interest rate fluctuations, and limited housing supply continue to drive rental costs upward. You can expect sustained demand from international students and new residents, particularly in areas like North York. Government policies and new development projects will shape future rental dynamics, making it essential to stay informed about market trends and regulatory changes.